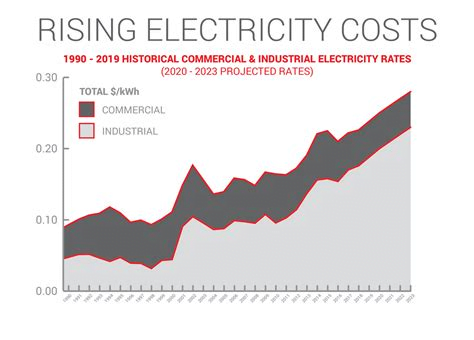

With the ever increasing costs for electric power, the high price of oil and the growing concern for the environment, many businesses are finding alternative sources of energy. Solar renewable energy is a sustainable choice and one that can be used in many commercial situations.

With the ever increasing costs for electric power, the high price of oil and the growing concern for the environment, many businesses are finding alternative sources of energy. Solar renewable energy is a sustainable choice and one that can be used in many commercial situations.

Top of the list of reasons to go solar are the reduced operating costs. Solar power systems will reduce or even eliminate your company electric bill. Businesses of all sizes can benefit from the money savings which can have a tremendous impact on operating budgets.

Having a solar power system installed will lock in the prices for up to 20 or 30 years. Better planning of operating costs month over month.

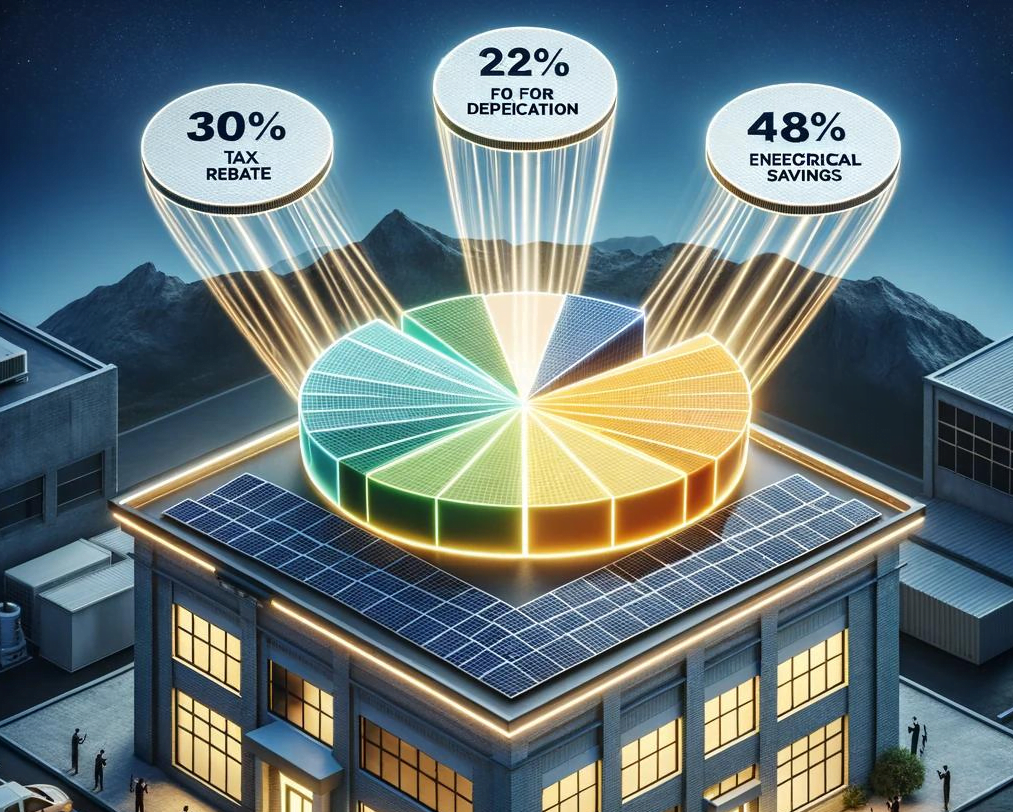

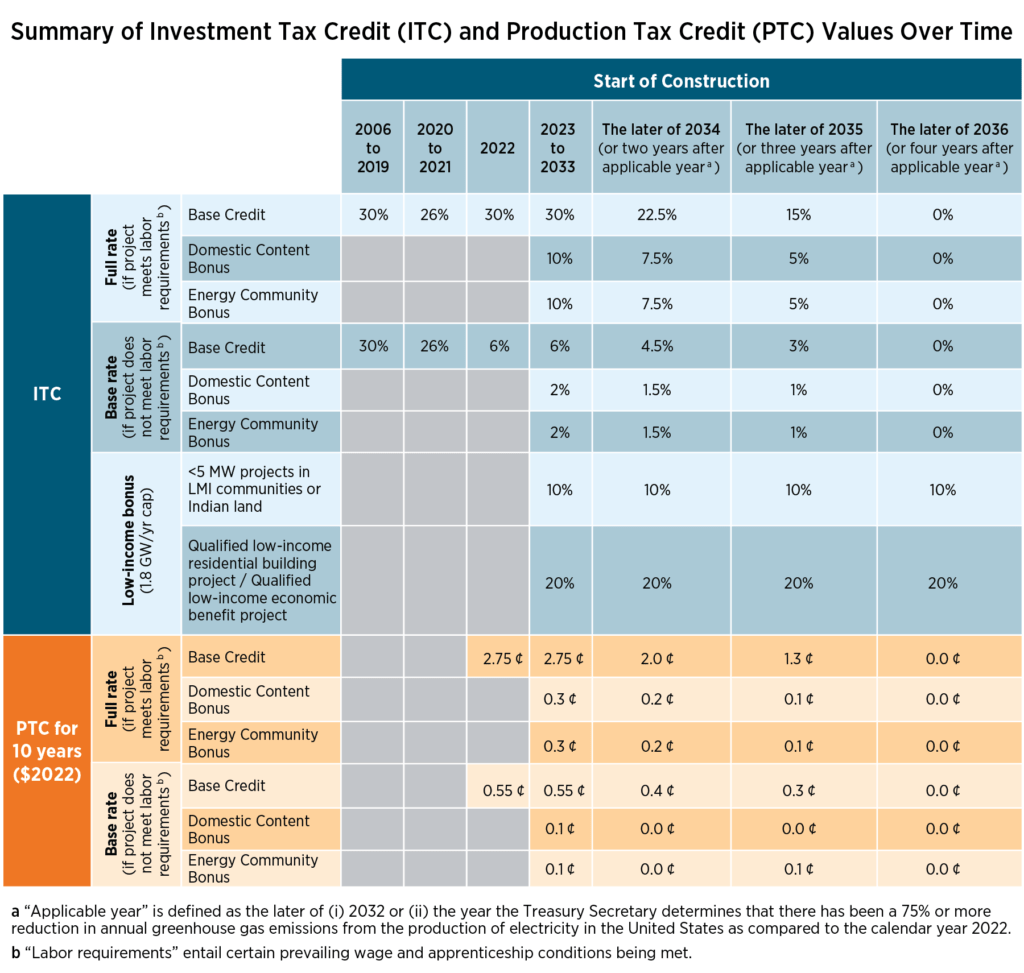

ROI shows time and again that going Solar is a smart investment. Government incentives as well as a speedy depreciation of the costs means the utilization of solar power is a sound investment. With the new Inflation Reduction Act signed in 2022 it means it is a good financial decision for public agencies, nonprofits and most businesses.

Once installed, a solar power system will require little or no maintenance at all, most especially if there are no batteries being used. The system will provide electricity quietly and cleanly for 25 to 40 years. Many solar panels carry a 25-year warranty. With Caldus Energy the system will have a Solar Insure plan covering it for 20 years.

Utilizing electricity from solar power will result in lower consumption of fossil fuels, reducing greenhouse gas emissions and pollution. By using this alternative source, any business or company can show dedication in the battle against global warming and can reduce the country’s dependence on foreign sources.

Going green will not only reduce operating expenses, it is also a great PR and marketing tool. Having an environmentally responsible image is good for any company, as it can generate a positive response from consumers.

For more information on what commercial solar can do for your business .

Contact us below.