One Power Program

On August 16, 2022 the Inflation Reduction Act (IRA) was signed into law.

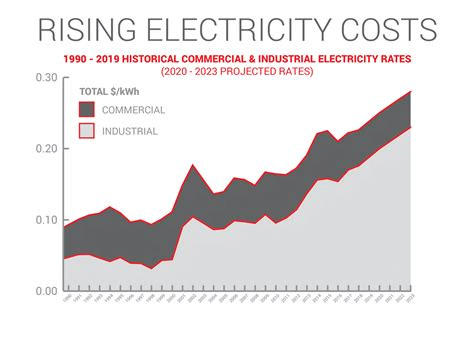

The IRA provides substantial funds to tax-exempt organizations and political subdivisions interested in converting their electricity usage to green energy. In fact, the IRA allocated $369 billion dollars over the next 10 years to fund energy and climate projects in an attempt to reduce emissions by approximately 40% by 2030. One of the most innovative aspects of the IRA involves its creation of a direct-payment methodology that is available, in lieu of providing a non-refundable credit, to entities who do not traditionally file tax returns.

The Inflation Reduction Act (IRA) changes the landscape of what’s possible for faith communities when it comes to solar and energy efficiency. For example, did you know that this new law now makes it possible for nonprofit organizations to receive a direct payment from the federal government that equals 30% of a solar installation’s cost.

The direct payment provisions of the IRA are codified in IRC 6417. This section provides an ability for eligible entities to receive direct cash payments from the federal government in lieu of income tax credits that would likely be of little use. Entities eligible for direct payments include tax-exempt entities, states and their political subdivisions, the Tennessee Valley Authority, Indian Tribal governments, Alaska Native Corporations, and corporations that operate on a cooperative basis to engage in furnishing electric energy to people in rural areas. Thus, this list would include 501(c)(3) organizations like hospitals and private colleges, 501(c)(4) social welfare organizations, and 501(c)(6) trade associations. It would further include cities, counties, public school districts, public universities, and other similar entities.

What does all this mean ?

In the past , Non-Profits were not able to participate in these programs because of their tax exempt status. No tax paid … No Tax credit .

The new Direct Pay program levels the playing field between taxpaying and non-taxpaying entities and opens the door for everyone to access these incentives. This drives down the cost of Solar, saving you money on your electric bills , providing more money for your cause.

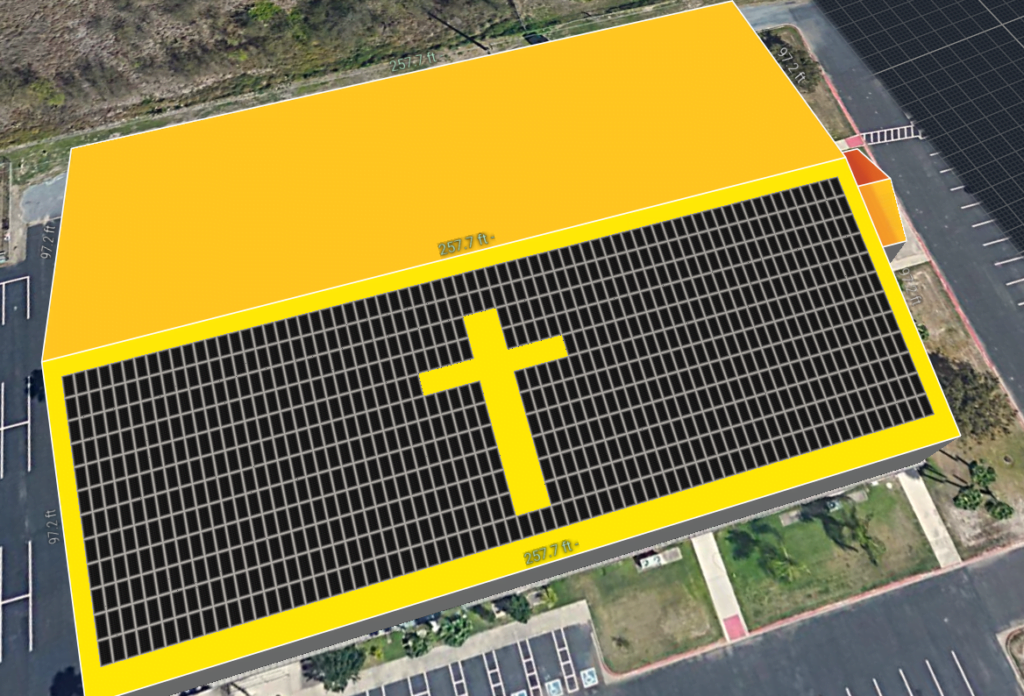

Our One Power Program is specifically designed to serve religious organizations to help them take advantage of these new tax incentives , lower the cost of operation and save significant money over time .

Next Steps

Lets have a 15-30 Minute call . We can explore your options and find out more about your needs . We can then offer a free energy analysis to show your your savings .

Please use the form to set up a meeting time that works for you .