Solar power is an increasingly popular energy source that can benefit businesses in a variety of ways. By investing in commercial solar installation, companies are able to save money, reduce their environmental impact, and increase the reliability of their energy supply. In this blog post, we’ll discuss the many advantages of solar power for businesses and why investing in a commercial solar installation is a wise decision.

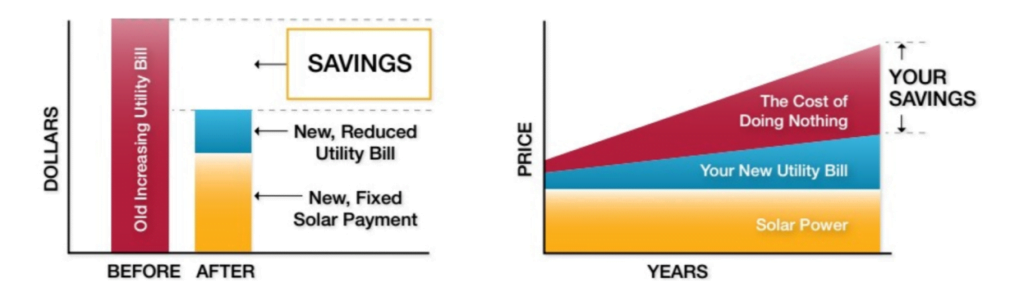

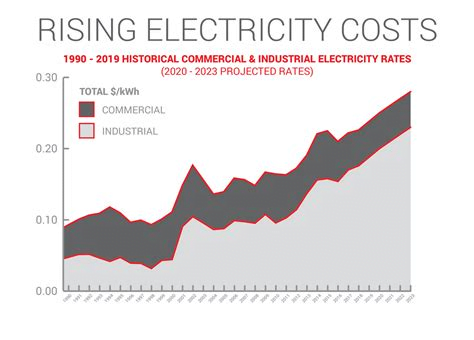

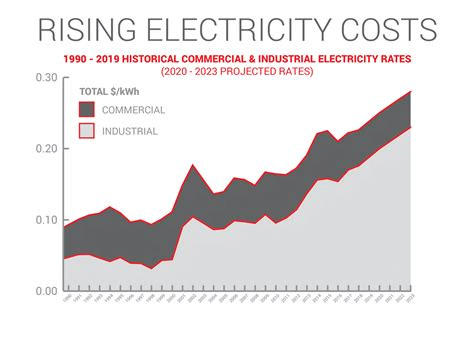

Solar power is an excellent way for businesses to reduce their energy costs while also reducing their environmental footprint. Commercial solar installation provides businesses with lower operating costs due to reduced electricity bills, as well as the potential for tax incentives and accelerated depreciation. With commercial solar power, businesses can benefit from reliable electricity supply and potentially receive credits for excess energy generated. Lower energy costs over time add up to significant savings for businesses, making solar power an attractive option for many companies. With solar panels, businesses can enjoy clean energy that is both renewable and affordable.

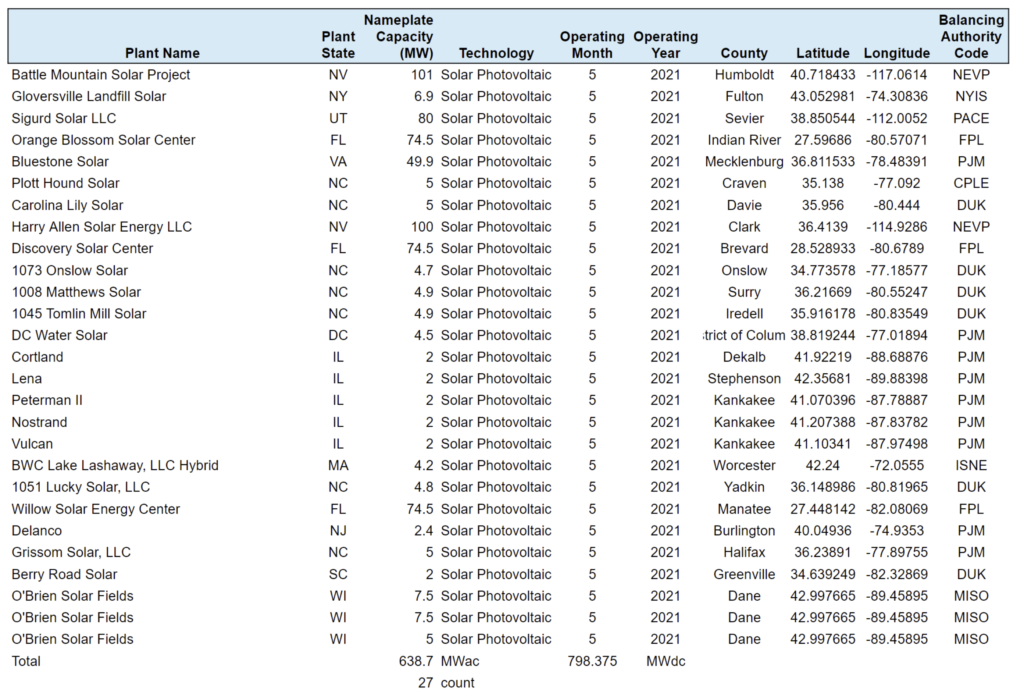

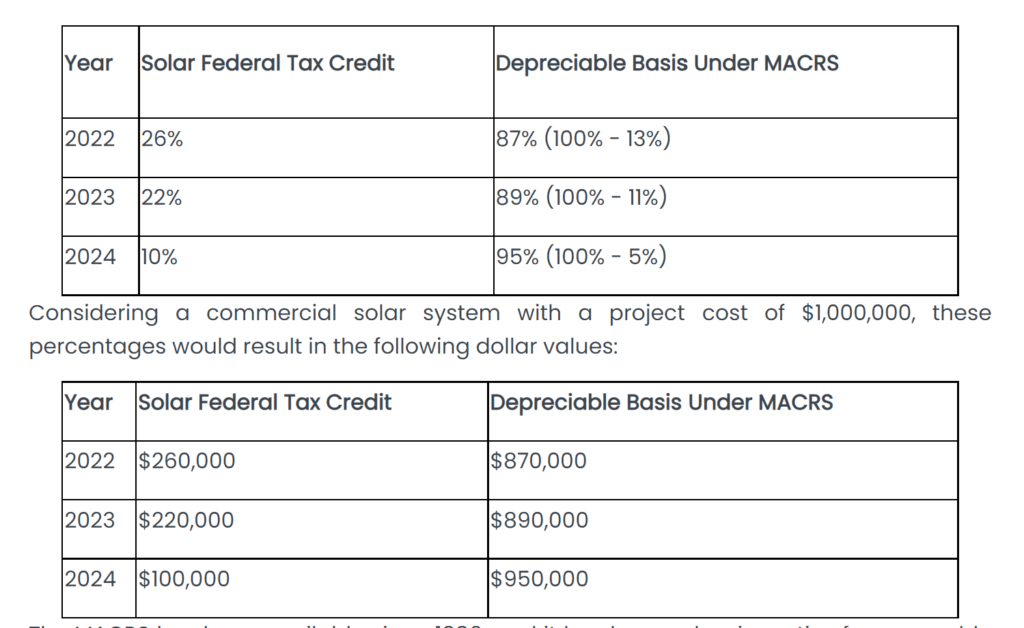

Business-owned solar power systems are eligible for two nationwide incentives in the US: the Investment Tax Credit (ITC) and the Modified Accelerated Cost Recovery System (MACRS). You can combine the ITC and MACRS, but you must subtract half of the ITC from the solar asset value. If you’re considering solar power for a commercial or industrial building, you have most likely heard about the Investment Tax Credit (ITC). Thanks to the ITC, you can claim 30% of your solar PV system costs as a federal tax credit on your next tax payment as well as 80% accelerated depreciation in 2023. The ITC and MACRS are just two of the many benefits of solar power for businesses, and the financial incentives are a great way to ensure that your solar system pays for itself in no time.

The benefits of solar power don’t end there. Solar power is also an environmentally friendly solution to your business’s energy needs. By utilizing solar energy, you can significantly reduce your carbon footprint and help make the world a cleaner, healthier place. What’s more, you can save a great deal of money on energy bills in the long run. Going solar has never been easier, and with these incentives in place, it’s an even more attractive option for businesses looking to get the most out of their energy sources. With all the benefits of solar power readily available, why would any company not want to invest in this clean renewable energy?

Contact us for more information

With the ever increasing costs for electric power, the high price of oil and the growing concern for the environment, many businesses are finding alternative sources of energy. Solar renewable energy is a sustainable choice and one that can be used in many commercial situations.

With the ever increasing costs for electric power, the high price of oil and the growing concern for the environment, many businesses are finding alternative sources of energy. Solar renewable energy is a sustainable choice and one that can be used in many commercial situations.